| VCBF BLUE CHIP FUND | |

| As of 23 April 2024 |

|

| Symbol | VCBF-BCF |

| Inception date | 22/08/2014 |

| License number | 13/GCN-UBCK |

| Supervisory bank | Standard Chartered Bank |

| Auditor | N/A |

| Distributors | VCBF, SSI, VCBS, FMARKET |

| Profit distributions | N/A |

| Net Asset Value | 484,963,428,926 VND |

| NAV/unit | 30,461.1 |

| NAV change since last period | |

| YTD Total Return at NAV | |

| Highest NAV per unit (52w) | 19,262.07 |

| Lowest NAV per unit (52w) | 13,070.46 |

| Number of outstanding units | 15,920,743.27 |

| % of foreign ownership * | 21.14% |

| Distribution rate at NAV * |

N/A |

| Expense ratio and Turnover rate |

|

| Operating expense rate (%) * | 2.28% |

| Portfolio turnover rate (%) * |

19.10% |

| Porfolio positions * | 25 |

|

(*) Update on 23 April 2024 |

VCBF Blue Chip Fund (“VCBF-BCF”) is an open-ended fund which invests up to 100% of its Net Asset Value in listed equities with large market capitalization and good liquidity.

The investment objective of the Fund is primarily to provide medium to long term capital appreciation.

The Fund will primarily invest in a diversified portfolio of stocks listed on the Ho Chi Minh Stock Exchange (“HSX”) and the Ha Noi Stock Exchange (“HNX”) which have a large market capitalization and are liquid. Stocks with large market capitalization are considered as those with market capitalization larger than the hundredth largest stock listed on the HSX.

The Fund follows a blend of value and growth style of investing.

The Fund will follow a bottom-up approach to selecting stocks for investment, focusing on the individual attributes of a company, and choosing companies across sectors.

The Fund gives you the opportunity to increase long-term returns through investment in a diversified portfolio of companies that are considered to be the best in their industry, i.e. Blue Chips. These companies typically have good growth prospects, have good management teams and are priced reasonably or undervalued.

VCBF Blue Chip Fund is an open-ended fund. You can read more about benefits of an open-ended fund in "Benefits of OEFs" item on menu “Open-end funds”.

VCBF Blue Chip Fund focuses on generating long-tern returns from investments in large cap companies, hence could be considered as a core equity portfolio for all type of investors with an investment horizon of 3-5 years or longer.

| Portfolio Details | ||

| As of 31 March 2024 |

|

|

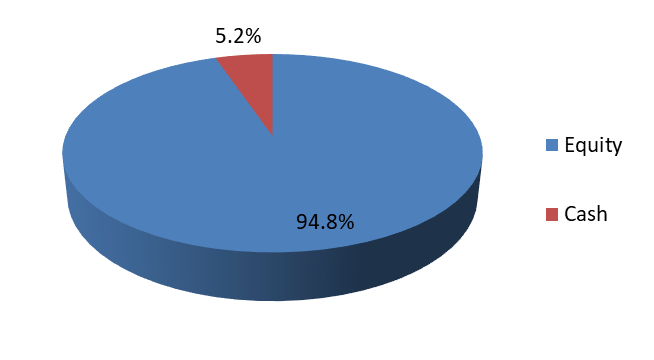

| Asset Mix | ||

| Equity | 94.8% | |

| Cash |

5.2% |

|

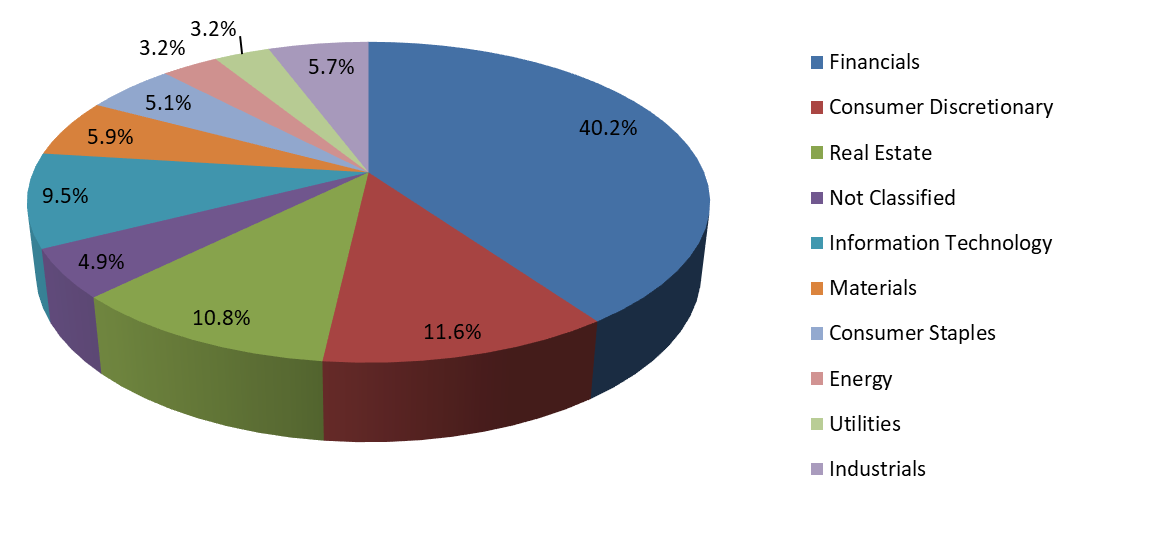

| Industry Breakdown | ||

| Financials | 40.2% |

|

| Consumer Discretionary | 11.6% | |

| Real Estate |

10.8% |

|

| Not Classified |

4.9% |

|

|

Information Technology |

9.5% | |

| Materials | 5.9% | |

| Consumer Staples | 5.1% | |

| Energy | 3.2% | |

| Utilities | 3.2% | |

| Industrials | 5.7% | |

| Top 05 holdings |

|

| Company short name | % of NAV |

| FPT Corp (FPT) |

9.0% |

| Saigon Thuong Tin Commercial JSB (STB) | 9.0% |

| Military Commercial JS Bank (MBB) | 8.5% |

| Mobile World Investment Corp (MWG) | 7.2% |

| Hoa Phat Group JSC (HPG) | 5.6% |

| Total | 39.3% |

You want to invest? Please fill the form: