| As of 16 April 2024 |

|

| Symbol | VCBF-TBF |

| Inception date | 24/12/2013 |

| License number | 07/GCN-UBCK |

| Supervisory bank | Standard Chartered Bank |

| Auditor | Ernst & Young |

| Distributors | VCBF, SSI, VCBS, FMARKET |

| Profit distributions | N/A |

| Net Asset Value | 279,677,658,743 VND |

| NAV/unit | 29,753.03 |

| NAV change since last period | |

| YTD Total Return at NAV | |

| Highest NAV/ unit (52w) | 210,441.92 |

| Lowest NAV/ unit (52w) | 15,912.72 |

| Number of outstanding units | 9,399,970.86 |

| % of foreign ownership * | 32.98% |

| Distribution rate at NAV * | N/A |

| Expense ratio and Turnover rate |

|

| Operating expense rate (%) * | 1.99% |

| Portfolio turnover rate (%) * | 24.13% |

| Portfolio Positions * | 35 |

| (*) Update on 16 April 2024 |

The fund has flexibility in asset allocation taking either defensive or aggressive postures depending on opportunities available at various points in time. Under normal market conditions, the fund will invest 50% of its NAV in equity and 50% in high quality fixed income assets.

The fund seeks long-term total return via growth of capital and current income.

The fund invests in a diversified portfolio of listed common stocks, primarily in stocks with large market capitalization and Vietnam Government bonds, municipal bonds or bonds guaranteed by the Government or high quality listed corporate bonds.

The fund actively seeks an optimal mix of equity and fixed income by evaluating risk and return of investment opportunities across the asset classes.

The fund follows a blend of value and growth style of equity investing and follows a bottom-up approach to stock-picking by valuing fundamentals of the companies.

The fund offers a broad diversification and balanced exposure to the asset classes, making it attractive as a solid core holding in an investor’s portfolio.

The fund benefits from a flexible asset allocation strategy when economic conditions change.

VCBF Tactical Balanced Fund is an open-ended fund. You can read more about benefits of an open-ended fund in “Benefits of OEFs” item on menu “Open-end funds”.

| Portfolio Details | ||

|

As of 31 March 2024 |

|

|

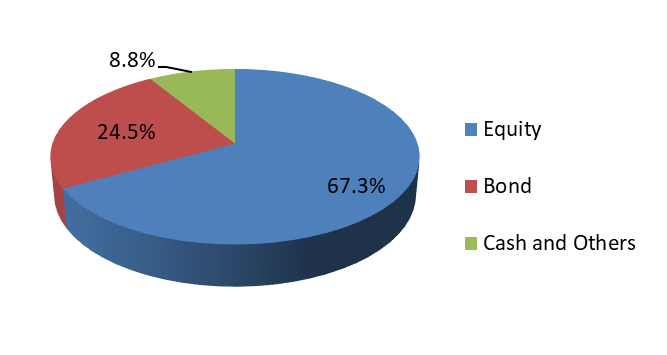

| Asset Mix | ||

| Equity | 67.3% | |

| Fixed income |

24.5% |

|

| Cash and Others | 8.8% | |

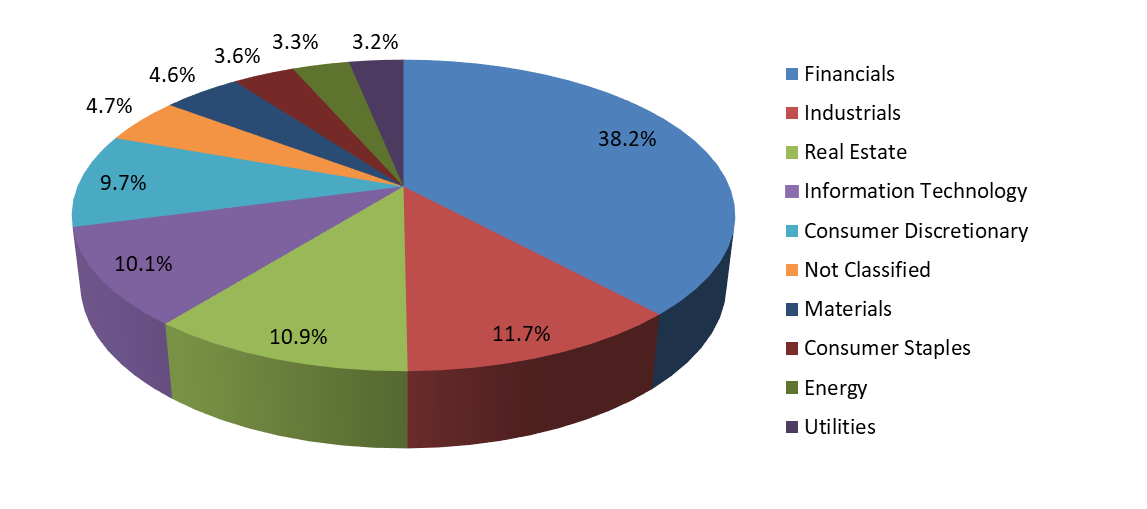

| Industry Breakdown |

||

| Financials | 38.2% |  |

| Industrials | 11.7% | |

|

Real Estate |

10.9% | |

| Information Technology | 10.1% | |

| Consumer Discretionary | 9.7% | |

| Not Classified | 4.7% | |

| Materials | 4.6% | |

| Consumer Staples | 3.6% | |

| Energy | 3.3% | |

| Utilities | 3.2% | |

| Top 05 holdings |

|

| Company short name | % of NAV |

| Bond of Masan MEATLife (MML121021) |

8.1% |

| FPT Corp (FPT) |

6.8% |

| Military Commercial Joint Stock Bank (MBB) | 5.6% |

| Sai Gon Thuong Tin Commercial JS Bank (STB) | 5.4% |

| Mobile World Investment Corporation (MWG) |

4.5% |

| Total |

30.5% |

You want to invest? Please fill the form: